What’s inside: Three ways to reduce your college costs while still in high school with two additional ways while in college! Why? Because college costs are too high. Here are ways that one student used to graduate college debt-free.

Today, I am excited to have a guest post from regular contributor (and also my son) Josh Rudd. In today’s post, Josh looks at ways to reduce college costs.

* This post may contain affiliate links. If you find my content valuable and make a purchase through one of my links, I will earn a commission at no cost to you, which helps me keep this blog going so I can help you even more! I recommend products I trust and/or use myself, and all opinions I express are my own. Read the full disclaimer here.

Reduce College Costs in High School?

Why should you try to reduce colleges costs before you even get to college? Answer: there are about as many opinions on college as there are people, but one thing everyone can agree on is that it costs too much. Well, everyone except the people who run colleges.

How to graduate from college for under $15,000

We’ll look at three ways I actually used to reduce college costs starting while I was still in high school. And two ways I reduced my overall cost to under $15,000 while getting two bachelor’s degrees in 2-1/2 years; including:

- Testing out of credits with CLEP/AP/DSST exams

- Getting merit scholarships based on SAT/ACT scores

- Community college classes

- In-state colleges with resident tuition

- Distance learning (online college)

But first, how did college get so expensive?

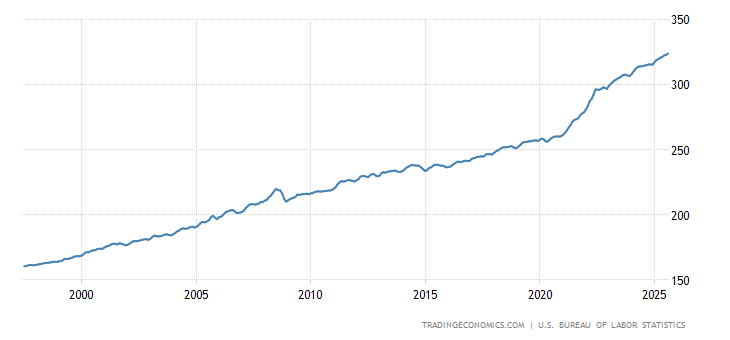

Since 1980, the consumer price index, a statistic which basically shows the inflation rate over time, has increased about 115%. That means on average something that cost a hundred dollars in 1980 costs $215 in 2021. (Editor’s note: This article was written before the recent surge in inflation.)

However over the same time period, the cost of college has increased to a range of 260% to 500%, depending on the level and category of college.

Can you afford college?

To give you an idea of what that means for regular people, in 1980, the average cost of attending college was about 10% of the average person’s income. Today, it costs almost 30% of the average person’s income. The intrinsic value of a degree with respect to your career has not tripled since 1980; it may have even decreased.

So can you afford to go to college? Can you afford not to?

What if I need that college degree?

But you may be thinking, “I’ve always heard that you have to go to college to have a successful career.” While this may be true, it doesn’t mean you have to blindly do things the way everyone else does, going to a normal four year college and racking up a pile of debt.

If did it, you can reduce college costs too

I entered college with an Associate’s degree in Economics and over 60 college credits and left college 2½ years later with no debt, and two Bachelor’s degrees (albeit two rather easy degrees, ha ha!)– Economics and Business.

If you are considering college, you can use the same strategies I used to reduce the cost of college to fifteen thousand dollars or less, total and get through college in half the time or less.

Spending less overall time IN college actually has the biggest impact on your overall cost, but the strategies that follow can help reduce your time in college also.

Strategy #1: Do this in High School

The simplest and possibly most effective strategy is to quiz out.

CLEPs

Everyone has heard of the ACT and SAT, but few have heard that the same company – the College Board – that provides the ACTs and the SATs, also offers what are called CLEP tests.

These tests are college level and focus on one subject, like biology, or algebra. If you pass a CLEP test you receive college credits for that subject. For example, if you passed the chemistry CLEP test you would receive 6 college credits in chemistry, and therefore would not have to take a first year chemistry course in college.

Beware!

Caveat: Not all colleges take all CLEP credits.

I actually passed the Natural Sciences CLEP, and my chosen school didn’t have a comparable course, so it only accepted some general elective credits for it.

And, funny story – I got a really high score on the Chemistry CLEP and they gave me more credits than they gave my brother, who also got a high score, but 2 points less than me. In general, the tests are “Pass/Fail” but there is an actual score behind them and some schools use that score to see how much credit they will give you!

For more information on how to take CLEP tests, read about my experiences here.

Other Tests

There are also AP and DSST exams which function the same way as CLEP exams. The cost of a CLEP or AP exam plus the cost of study materials for the exam is about $100-$150. The cost for getting an equivalent number credits on an average college campus is $2500 or more dollars.

AP Tests are usually given in conjunction with taking an actual high school class and then taking the test at the end of the year, but even homeschooled students can self-study and just take the test, as long as you sign up for them in advance with your local school or testing center. We found them a bit more restrictive to study and test for, so I only used them for 2 tests in Physics, but my brother took 4, including the Computer Science one, which was the easiest.

Just by taking a bunch of CLEP or AP exams, you can quiz out of much of the first two years of college for less than $2500.

Strategy #2: Take those tests & get scholarships

IF you are academically oriented, and you test well, take those SAT and ACT tests EVEN IF your chosen school no longer requires it.

Many state schools (which have lower tuition rates than private schools) will give merit-based scholarship determined ONLY on how much you scored on the ACT or SAT.

I received $4000 a year from this kind of merit scholarship.

It’s worth taking a chance

So you have nothing to lose by taking one or both of these tests.

If you are a super-test taker, take a couple of weeks and cram specifically for these tests using resources like Up Your ACT Score or The SAT Black Book (2nd edition). These strategic books are focused on improving your scores, and are recommended by the best SAT prep site PrepScholar. You can even take a course from them – they guarantee an improved score on your retake test.

UPDATE 2025: The Black Book has been totally revised for 2025-26 SAT testing! This book is a key to getting your best score on the SAT. It’s really a book about how to take a specific test. It is not really a living book, but if you know how to read for instruction AND you need to go to college and want to save money by maximizing your SAT score, then you will want a copy of The SAT Black Book Third Edition. If you learn better from guided courses, go with PrepScholar.

What if I hate testing?

Even if you despise this kind of test (which admittedly serves no learning purpose other than to improve your test-taking ability, it doesn’t even give you a proxy IQ score anymore), you may want to take them anyway.

My younger brother DETESTS! testing. It is not his strong suit. Yet, he crammed for a few weeks and got a high enough score to be eligible for some of these merit scholarships. And did I mention that he hates tests?

What about other scholarships?

Apply for a ton of scholarships and keep applying each year you are in college. Once you start looking, the quantity of scholarships available is staggering. Even those $500 scholarships add up to a lot. Apply for everything you qualify for – if you belong 4-H, apply for the 4-H scholarships. If you are an economics major, apply for economics scholarships.

If you get on a “dean’s list” with high GPA, apply to your college & major specific scholarships that are available. Some major-specific scholarships at your college only become available to you AFTER your freshman year, so keep checking what you are eligible for.

There are a lot of opportunities out there in the form of scholarships.

Strategy #3: Dual Enrollment Community College classes

Dual enrollment, also called concurrent enrollment or “running start” in some places, is a program where high school students can enroll in college classes in place of high school classes, thereby getting both high school and college credit for the same class.

Taking community college credits while in high school and getting both high school and college credits is a great option to save money.

Check your state’s programs

In addition to getting ahead on college, many dual enrollment courses can be paid for by a public or charter high school, if a student is associated with that school—saving the student a great deal of money as well as time.

42 states have some form of state-wide policy on dual enrollment.

In our state, there are a number of programs for high schoolers to take classes at free or reduced tuition. I took advantage of this and graduated high school with an Associate’s Degree for less than $3000 out of pocket.

Check and see if your state offers any program like this. The details of concurrent enrollment programs vary somewhat, but most have similar structures. Concurrent enrollment is usually offered by public and charter schools. Unfortunately, it is fairly uncommon in private schools unless that particular school has an agreement with a local college or university. In general, high school juniors and seniors with decent grades are eligible for dual enrollment classes. The school offering the classes will usually have a set number of college credits it will pay for on behalf of the student.

Even if they don’t, out of pocket costs will be smaller at a community college than costs at a 4-year institution.

Strategy #4: Option for College Courses

Another method to drastically reduce the cost of college is distance learning.

Online education has exploded, to the point where today there are several colleges that offer degrees completely online. Editor’s note: This article was written before everyone learned how to do school remotely. There are even more options available now for an online degree.

Getting a degree online is cheaper than at most colleges. It also removes one of the largest college expenses, room and board.

Not for every major

Online is great, if they offer what you want. Some of the most notable degree paths that still need in-person learning include the medical fields, some engineering fields, and some other professional programs.

Strategy #5: Stay in State

Finally, if for whatever reason you want to go to an actual college campus, there’s one simple trick that drastically reduces the cost of tuition.

The vast majority of colleges charge much higher tuition to out-of-state students, than in-state students, usually at least 50% more, and often two to four times more than they charge in-state students. Therefore, by simply establishing residency in the state your college is in, you can cut your tuition in half or more.

How to get that in-state rate

If your chosen school is not your home state, I found a method online which explains how to you can get the in-state college price.

Basically, as soon as you complete high school, you move to the state with the school you want to go to. Then you get some job that will pay for food and housing. For one year, you work, and take CLEP tests to quiz out of classes. Then, the next year, you apply to your chosen college and get the in-state tuition rate.

Because of the tests you took, you should be entering college as a sophomore or junior having quizzed out of the first one or two years. This means that not only do you get the in-state tuition, but despite taking a year off from school, you’re still equal to or even a year ahead of other students your age.

If you are lucky enough to live in the right state, you may be eligible for college reciprocity between neighboring states. Many western colleges for example offer “regional” rates, only charging residents of nearby states in-state tuition.

Reduce college costs now

The college system today is ludicrously overpriced for what it offers.

Fortunately, there are a multitude ways to get around the massive cost, in both time and money, associated with getting a degree. If you start taking college credit tests now, and do some research into online education, you can get a degree while massively reducing the costs of college.

I hope you can use these strategies to reduce your college costs too!