Homeschool Economics: A Fun Activity about Inflation

Woo hoo – Learning about inflation – so much fun for homeschool economics! Fun for the whole family!

This post may contain affiliate links. If you find my content valuable and make a purchase through one of my links, I will earn a commission at no cost to you, which helps me keep this blog going so I can help you even more! I recommend products I trust and/or use myself, and all opinions I express are my own. Read the full disclaimer here.

Seasonal Fun

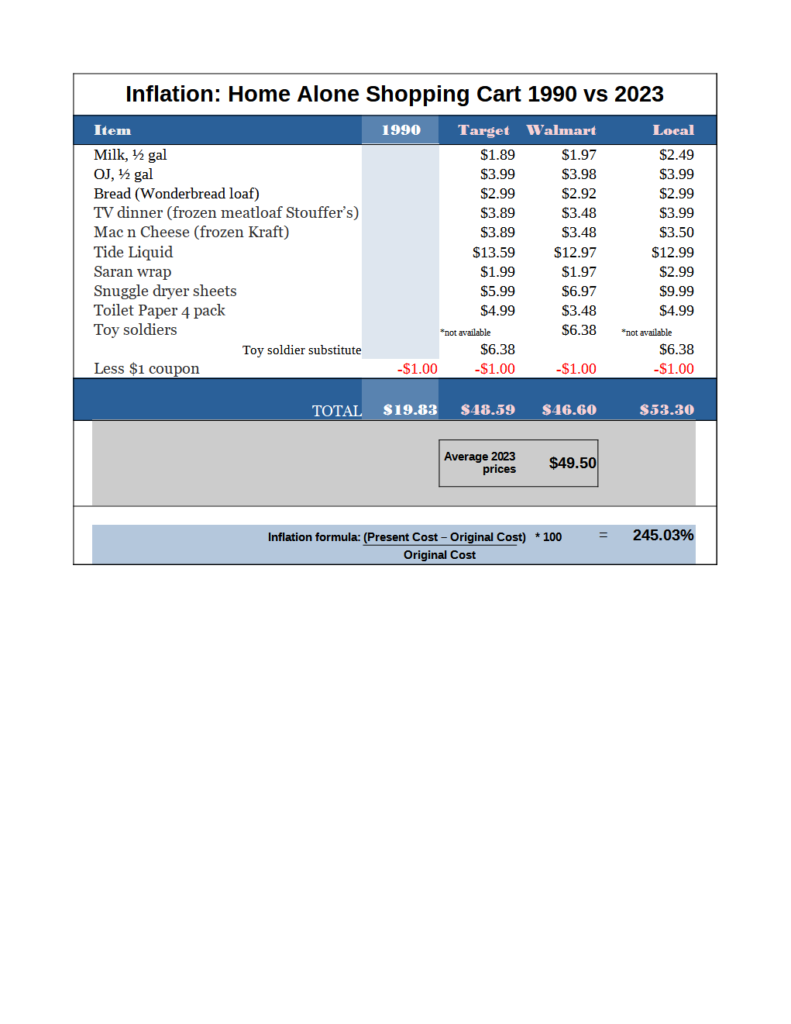

I’ve noticed the uptick in this interest in inflation because of the 1990 film Home Alone. The scene where our hero goes shopping on his own and picks up 10 household items for $19.83 including a $1 off coupon!

And now trending is the updated 2023 costs on various social media.

UPDATE 2024!

First, let me say that I am APPALLED to confess that I made an arithmetic error last year. Mostly because of a spreadsheet typo — REMINDER: You should always ESTIMATE what you think the answer is going to be to make sure you’re in the ballpark. The error was HUGE — I said 245% inflation when it was about 150% inflation from 1990 until 2023.

Second, WHY did NONE of you notice the error??? Not even my son, who graduated recently from college with dual degrees in applied mathematics and computer science!!! I’m doubly appalled. See the corrections as we go through the ACTUAL math.

2024 Calculations

The updated inflation calculations from last year to this year: In general, most prices were about the same. Last year the basket would cost $49.50 and this year it would cost $51.76. Which I calculate at 4.57% inflation from last year to this year. Which is higher than the two inflation calculators listed below, which think there’s only been 3% inflation this year.

But the biggest inflation problem was with milk and OJ. Those rose 32% and 14% respectively over the past year.

More Updates: 2025!

Good news, sports fans! Our inflation rate for this year has actually gone down slightly — we are at almost the same rate as 2023 — a 150.55% inflation since 1990. And that’s the good news. Milk prices are slightly down, OJ prices are way up but you can’t buy 1/2 gallons as easily so you don’t notice, and everything else is about the same.

Back to 2023 analysis…

When do you know it’s a trend?

If I hear about it, then it is trending. Because I don’t use social media (except for Pinterest for this blog). So if a trend eeks its way into someone who doesn’t look at trends, well, you know something is out there!

3 Reasons to Teach Economics in Homeschool

- It’s a practical application of Math.

- Inflation talks about History.

- It’s kind of fun to play with numbers.

What was in the video?

Little Kevin shops for normal things: Milk, orange juice, laundry detergent, etc. Watch it if you’ve never seen it.

What did it cost in 1990?

10 household items cost $19.83.

What would it cost today?

I shopped online at some local stores – Walmart, Target, and Safeway to compare. I came up with an average cost of $49.50 in today’s local cost. Update 2024: $51.76 and Update 2025: $49.68

Please note that Walmart was the only one that sold a bag of plastic toy soldiers, so I used their price for the other stores. Even Walmart doesn’t sell plastic toy soldiers anymore — the junky kind you used to be able to buy for a dollar. They have a large bucket of specialty ones for $15. Regardless, I used the same price for all stores of some cheaper plastic action figures.

Also, note that there is no way anyone should buy Wonder Bread if you want actual nutrition.

Here’s a comparison table:

Madeline Coggins, a writer for Fox News reported the story (I read her article on the NY Times website – I had to compare the 2 sites – I never knew they just used the exact same story in news outlets on the web. I guess it’s like an AP story.) She commented about a TikTok video that freaked everyone out because they came up with $72.28 for the total shopping cart. Her results were closer to mine at $44.40.

USA Today had an article on it also. USA Today spent $54.94 on the cart.

Still, that’s a 245% increase in inflation. <<<< No it isn’t!! It’s a 149.6% increase in inflation from 1990 until 2023! Math typo in my spreadsheet!

Pause

That’s 245% inflation in 33 years. <<<< No it isn’t! See above. It’s 149.6%.

Maybe you think that isn’t much.

Here’s where charts come in. And more math.

But first: Inflation Calculation

To calculate inflation:

Homeschool Economics

See? How we use math there? That’s a formula. You can do all kinds of things with formulas.

Note: That is a correct formula. But if you put the wrong numbers in, you get the wrong numbers out. That’s how formulas work. I think there is a life lesson here somewhere.

The Funny thing

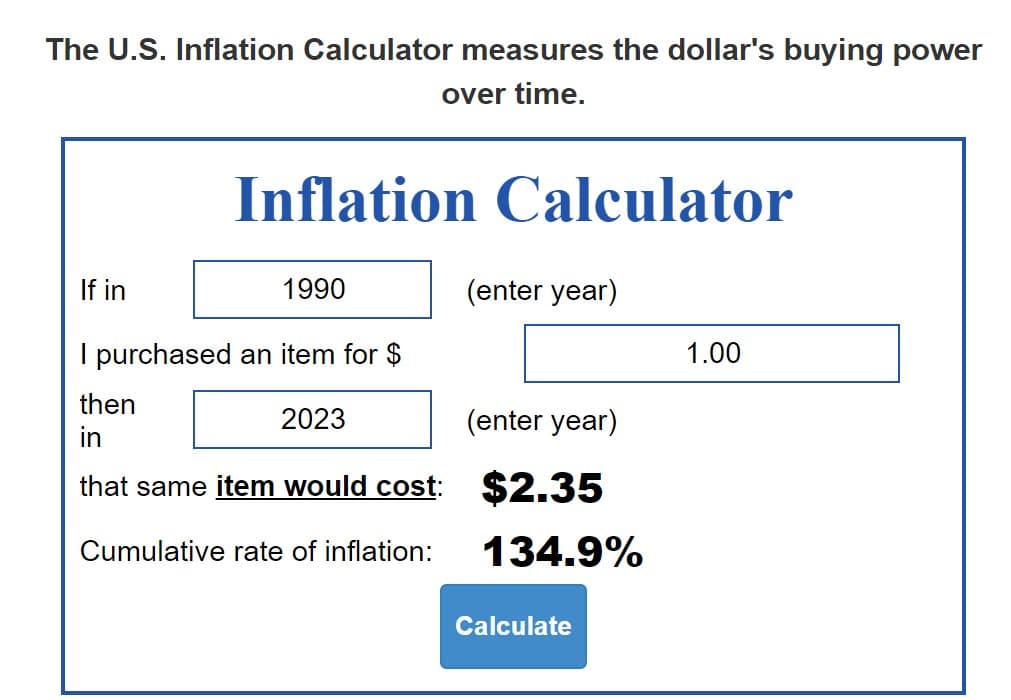

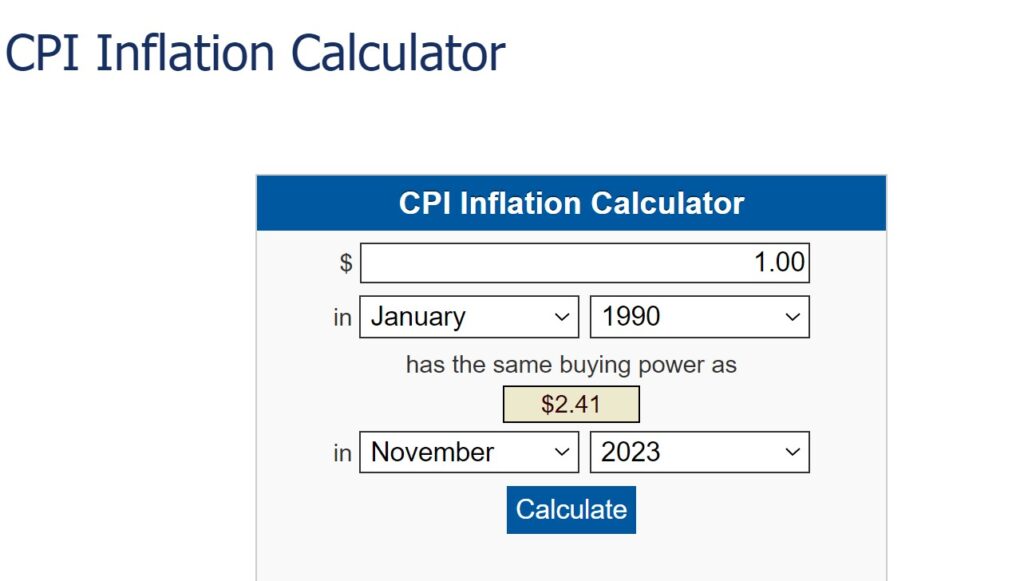

I noticed when you look up Inflation Calculators, they all are giving adjusted rates of 135%.

Note: You think that I might have figured it out and checked my formulas in my spreadsheet!

Inflation calculators

Adjusted Inflation vs. Buying Power

Buying power means that $19.83 worth of stuff in 1990 will cost you $45 and change in 2023.

Inflation generally refers to an increase in prices of various goods and services over time. If you’re wondering how to calculate the inflation rate, estimating the inflation rate involves some straightforward steps:

From How to Calulate Inflation Rate from indeed.com

- Subtract an item’s original cost from its present cost.

- Divide the result by the original cost.

- Multiply by 100.

What do economists think?

Actually, one of my favorite economists is “Uncle Eric”!

Here are some good quotes by Richard Maybury of the Uncle Eric series:

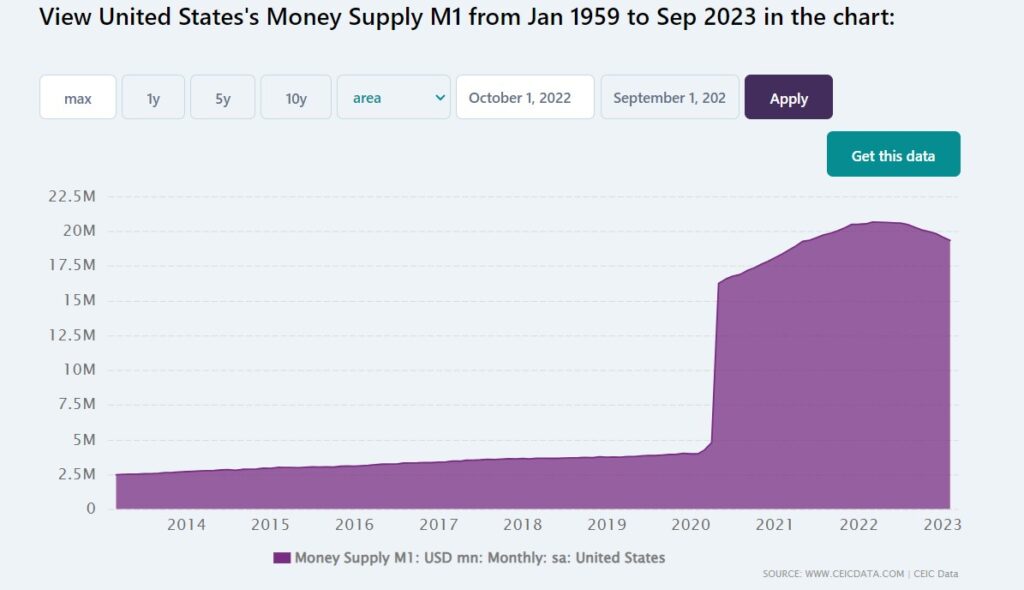

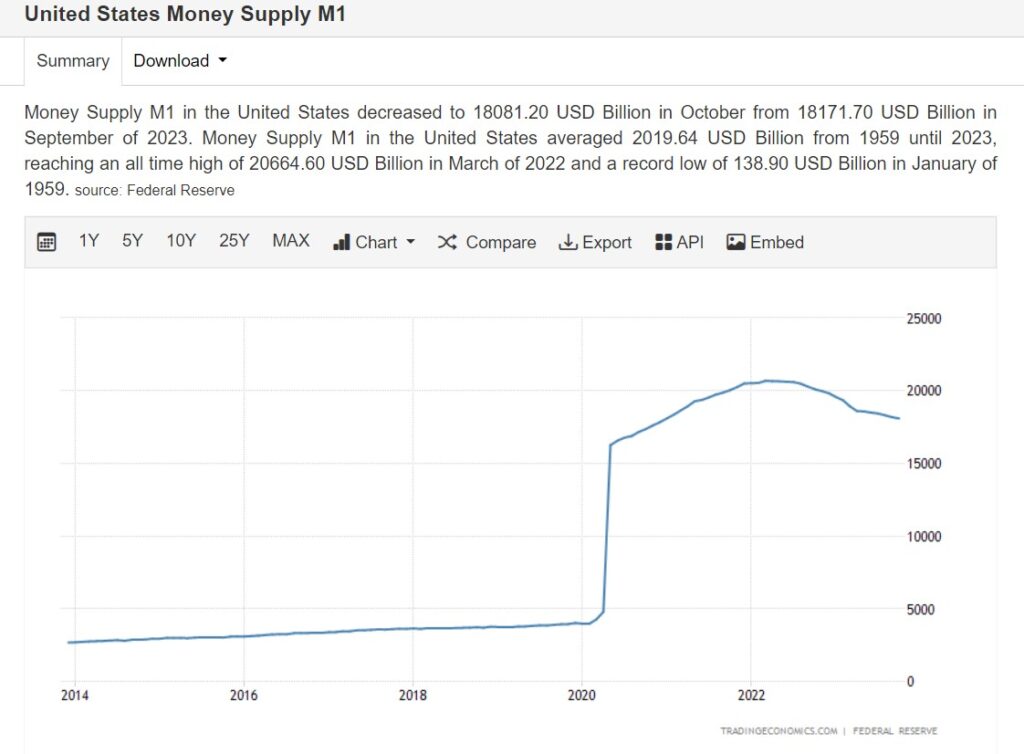

“The law of supply and demand affects money just as it affects pencils and everything else. If there is very little money the money is very valuable and it will buy a great deal. But if there is a lot of money it is not so valuable and it will buy very little.”

― Richard J. Maybury, Whatever Happened to Penny Candy?

“In 1968 there were about $200 billion dollars in the United States. Prices were not very high.

― Richard J. Maybury, Whatever Happened to Penny Candy?

In 2003 there were $1.3 trillion and prices are up.”

Penny Candy Update

Update: In 2023, there are about $18 trillion in circulation which is $2 trillion down since last year, but in the long term prices are up.

UPDATE 2024: In 2024, there are still about $18 trillion in circulation — except that I’m rounding. It’s actually $18.151 TRILLION. This means it’s up 151 BILLION from last year. It feels small. EXCEPT THAT IT’S NOT.

UPDATE 2025: In 2025, M1 is reported as $18,912 billion. The Fed is reporting it in billions now because no one understands trillions. So it must be ok, right?

See references below on What is the M1 money supply?

The Maybury Uncle Eric Books are fabulous as entry-level economics books. Read them aloud as a family or let your Form 3 (grade 7 or 8) kiddo read and narrate. Penny Candy talks about fiat money and inflation.

Another good book is The Richest Man in Babylon (free on Kindle at the moment!) It’s a great allegorical discussion of real money and wealth.

Do your kids know what Fiat money is?

Here are a couple of articles from Austrian economists, who don’t believe that fiat money is a good thing – they think it is better to have real wealth. Fiat money is money that is just printed and we all (socially) agree that it is worth something.

- The Fiasco of Fiat Money | Mises Institute

- What has the government done to money? | Mises Institute

- Fiat Money | Austrian Institute Wiki

Here are some charts to make you think. Plus charts are really math-y.

Homeschool Economics Fun: Field trip to the Supermarket

Go ahead — go to the supermarket with your kids to play this game. Get the prices of everything in the Home Alone cart. You don’t have to actually buy anything, especially not the Wonder Bread. You can also shop virtually.

Shopping list:

Play Games in the Supermarket

- Add up the totals in your head. Everyone keeps a running total and then the one who is closest wins.

- Estimation: The one who can estimate closest to actual wins.

- Coin games: Ask how much change they would get from a $5 bill for any item. Have kids translate it into how many of each coin.

- Rounding: Have them round to the nearest dollar.

Whatever you do, don’t buy the Wonder Bread.

Summary

Teaching your children practical applications of math is worth your time and worth it for the future. Remember, you never can tell what ideas take hold in a young mind!

Bonus Definitions (Quotes)

Inflation is a general increase in the prices in an economy over time. This results in lower purchasing power for the relevant currency. Inflation is an expected occurrence in modern economies. Inflation is primarily due to a constant increase in the monetary base by the local government or central bank.

– River Learn

Cumulative inflation is calculated by first choosing a good or basket of goods, and then dividing today’s price by the price at the start of the period. Then subtract 1. If the resulting number is greater than 0, the price of that good has inflated. For example, in 1990, an item was priced at $100, and in 2021 that same item is priced at $208. ($208/$100) – 1 = 1.08. Accordingly, the cumulative inflation rate since 1990 is 108%.

– River Learn

Books referenced in the post

- Uncle Eric Series (not an affiliate) by Blue Stocking Press

- Richest Man in Babylon by George S. Clasen

- Tuttle Twins and the Creature from Jekyll Island by Connor Boyack (good for littles)

- How Much is a Million? by David M. Schwartz, illustrated by Steven Kellogg (good for littles)

For more Study

- Living Math Books

- Cumulative inflation rate vs inflation | River.com

- What is an Inflation-Adjusted Return? | Investopedia

- How to Calculate Inflation Rate | Rocket Money

- Home Alone Article 250% increase in grocery prices by Madeline Coggins (also posted on NYPOST) | Fox News

- Wonder Bread: Not Good for Your Health | The Naked Label

Fiat Money:

- The Fiasco of Fiat Money | Mises Institute

- What has the government done to money? | Mises Institute

- Fiat Money | Austrian Economics Wiki

- Fiat Currency | Nerd Wallet

M1 Money Supply

- December 2020 data there was $2,040.7 billion in circulation | US Currency.gov

- What is a $ Trillion | Imagination Station Toledo

- Oddly, Wikipedia has the currency in circulation at $2.3 trillion, but they do footnote to the FED | Wikipedia

- M1 money | Statista

- Federal Reserve Data is published regularly | FED